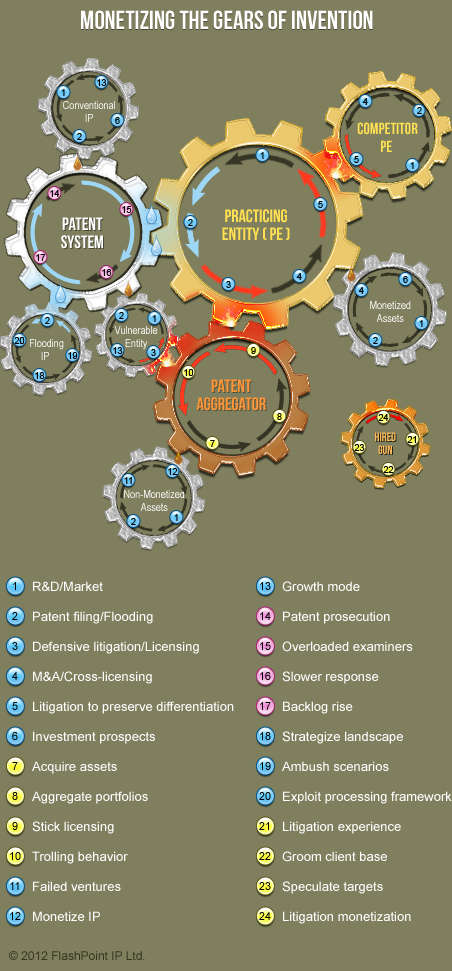

Monetizing the Gears of Invention:

Monetizing the Gears of Invention:

A Practicing Entity (PE) obviously covers a broad range of businesses that commercialize and market product or service technology to one or more industrial sectors. The classic cycle of PE activity starts with R&D along with business development and marketing efforts. This is followed by securing IP rights through patent filing in the Patent System. Patent filing may be accelerated by the PE’s IP management, with smaller “units of innovation” being “discretely quantized” into separate patent applications in the “arms race” mindset for IP strategy that was previously discussed. Such patent-flooding practice is described in more detail below.

The PE then may become embroiled in defensive patent litigation with a Patent Aggregator, or may seek to agree to license IP rights from the Patent Aggregator (discussed below). Sparks can fly as such patent litigation can create substantial risk exposure for the PE, interfering with product development, tarnishing consumer image, dampening investor enthusiasm, and draining valuable resources.

In engaging B2B partners, customers, and suppliers, the oiled gears of invention and IP management turn smoothly for the PE through M&A and cross-licensing activity. Litigation to preserve differentiation (whether defensive or offensive) with a Competitor PE differs greatly from the threat of litigation with a Patent Aggregator discussed above. Countersuits can be filed to restrict sales through injunctive relief as well as to seek damages as part of a sophisticated IP strategy. A Competitor PE cycle largely resembles that of any other PE with R&D, patent filing, M&As and cross-licensing, and possible patent litigation to preserve differentiation.

Crucial transactional assets associated in the interactions also synchronize their “teeth” with PEs. Monetized Assets can arise through R&D and patenting efforts of a smaller PE or startup in asset-procurement stages. Such assets are typically of immense value to larger PEs to augment and enhance their product offerings as exercised through an effective IP strategy. Asset transactions are realized through business vehicles such as M&As and cross-licensing. Typically, the nurturing of such monetizable assets attracts investment prospects for further leveraging an entity’s core capabilities in its scheme of IP management.

While we have described in detail how a Patent Aggregator can vary greatly in its practice, typically a Patent Aggregator initially relies on acquiring assets. Secured funding commitments for acquisitions are usually the impetus for the formation of such entities. Once acquired through various patent-sales channels which can efficiently “crowdsource” the diffuse mass of individual inventors as asset holders, assets are aggregated into portfolios through IP management as a form of productization for specific market segments. Aggregators such as IV may also maintain in-house R&D efforts as well as form strategic relationships with university TTOs as alternate sources for building up their asset base.

“Stick” licensing as a core IP strategy may be disconcerting to some, but it acknowledges the reality that a Patent Aggregator (lacking products, and thus, a common consumer base, there is no “carrot” to dangle) often has little to reciprocate to the licensor other than a freedom to operate or a covenant not to sue. In some instances, a Patent Aggregator may exert pressure on a Vulnerable Entity by threatening patent litigation which the Aggregator knows the other party cannot survive, or will not want to enter, in order to extract licensing agreements for assets that are not infringed by the other party’s products. Such heated “lock-up of gears” is true trolling behavior, and should be discouraged for ethical reasons, as well as for the long-term economic destruction of value which results.

Non-Monetized Assets start on a similar path as Monetized Assets in asset procurement through R&D and patenting efforts. However, in this case, for various reasons, the assets were not monetized due to failed ventures. By “engaging gears” with a Patent Aggregator, inventors and asset holders can monetize IP, albeit modestly, that was previously only a sunk cost.

Similar to a “mini-PE,” a Vulnerable Entity procures assets through R&D and patenting efforts, promulgating the entity into a growth mode either through increased sales or investment. However, due to its small size, a Vulnerable Entity cannot sustain defensive patent litigation against a Patent Aggregator. Thus, such a Vulnerable Entity is an easy target for an Aggregator to use such trolling behavior. Many times the Vulnerable Entity complies with the terms of a licensing agreement, even in situations in which the assertion is considered frivolous and unwarranted.

The Patent System focuses primarily on patent prosecution, issuance, and maintenance. In providing a legal framework for inventors to submit their inventions in exchange for protection, the Patent System incentivizes various forms of applicant behavior based on the changes it introduces into the patent examination and filing protocols. In industrial environments in which patent wars are rampant, patent flooding by PEs and other patenting entities can result in overloaded examiners, causing slower response, poorer examination, and a rising backlog.

Conventional IP is the result of R&D and patent filing which is used to attract investment prospects and sustain growth in the context of a typical IP strategy. In contrast, Flooding IP typically starts by strategizing an IP or technology landscape. Potential ambush scenarios are created to catch technology implementers off guard. Once such competitive intelligence has been mapped into an IP strategy, patent-flooding practices are used such as through assembly (as in the case of the NTP example described) or by disassembly (the “slice and dice” approach). With a portfolio of pending applications burgeoning the Patent System, Flooding-IP schemes usually attempt to extend provisional rights by exploiting the patent-processing framework (such as through delayed and incomplete responses in a Lemelson-like manner, and through extensive continuation practice).

Finally, the enamor of large litigation fees can lure top legal talent away from established law firms to become a Hired Gun. Once a lawyer has acquired substantial patent litigation experience, venturing out of the firm alone or with a newly-formed legal entity can be an appealing alternative. A Hired Gun almost always grooms a selective client base with the criterion of IP management of desirable assets, which is usually related to the speculative targets that the Hired Gun has in its sights. Once locked on a target, a Hired Gun relies on successful litigation monetization for wealth generation.

It should be understood that the gears are monetized only when they are engaged with another gear. While not all of the “active” gears (blue- and yellow-stepped gears depicted) are shown engaged with other gears, it is presumed that monetization occurs through such engagement with similar gears not shown in the depiction.

The Patent System (pink-stepped gear depicted) is an “enabling” gear in that it does not directly participate in monetization even when engaged with other gears, except through fee collection which can be considered a form of institutional monetization of IP rights. Whereas the active gears monetize (in the broadest sense) patents through commercialization, licensing, and sale, the Patent System (as well as patent-prosecution law firms – another enabling gear, not shown in the depiction) can be thought to monetize ideas into patent applications and patents.

Who are the good trolls?

So, if it can be said that there is a test for an NPE or PAE to be a troll, we hope that we have enlightened you with some of the attributes used to benchmark such a metric within the context of IP strategy. You’d be surprised to find out that a good troll is not an oxymoron in that when aggregators enable reduced transaction costs and principal-agent problems to efficiently-optimize IP management, such entities can help usher in a full-fledged IP marketplace, with all the economic benefit that it entails. That being said, it seems that the term troll has taken its toll on our IP sensibilities – it’s high time to shift gears, and shift our way of thinking.